In 2025, the world may face turmoil: the IMF has released a new scenario predicting the duration of the war in Ukraine.

Experts from the International Monetary Fund (IMF) have updated their negative forecast for Ukraine, considering the potential extension of the war for a longer period. According to the new scenario, the conflict may last until mid-2026. This will have serious repercussions for the country's economy.

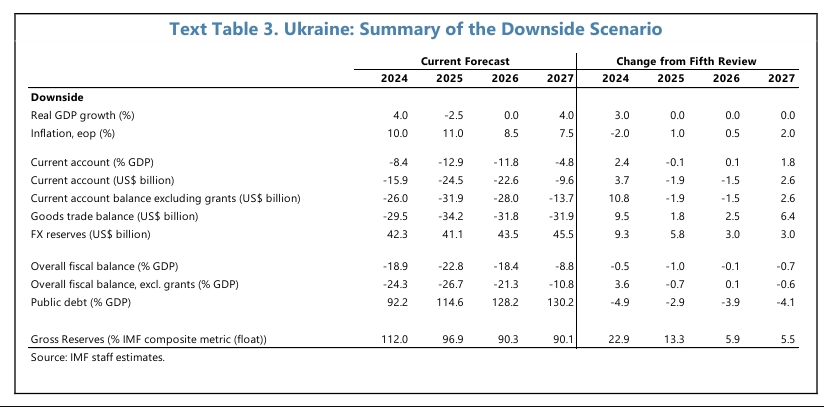

This negative outlook reflects the possibility of more intense combat actions, which, in turn, will lead to more significant economic losses. While the initial scenario anticipated the conflict's resolution by the end of 2025, the revised forecast suggests that the external financing deficit will rise to $177.2 billion, compared to the previous $148 billion. Overall, key macroeconomic indicators will be considerably worse, with a projected decline in real GDP of -2.5% in 2025.

Particular attention in the forecast is given to the war's impact on Ukraine's energy infrastructure, which may result in even greater destruction and power supply disruptions, compared to the baseline scenario. Consequently, economic recovery will be slowed down, and inflation will remain high.

Despite the negative forecasts, the IMF notes the stability of the support program for Ukraine. Discussions with the government and international partners indicate the reliability of financial guarantees, allowing for expectations of achieving macroeconomic stability even under these circumstances. Additionally, in the medium term, there is a possibility of gradually approaching baseline indicators due to Euro-integration and reverse migration.

The updated forecast also takes into account higher defense needs and economic weakness, which will lead to an increase in the budget deficit in 2025-2026. At the same time, the inflation and economic growth forecasts will remain moderate, with the pace of economic recovery being slow compared to optimistic estimates.

IMF Preliminary Forecasts

It is worth noting that in October, the IMF revised its estimates regarding the war, extending the expected end date to 2025. Previously, in June 2024, the baseline scenario anticipated the war's end by the close of 2024.

The NBU will continue to gradually weaken the hryvnia exchange rate, as the regulator aims not to create new inflationary risks. The devaluation for the full year will be no more than 10%, and the exchange rate at the end of next December is expected to be slightly below 46 UAH/$.

Additionally, new agreements with the International Monetary Fund (IMF), under which Ukraine will receive $1.1 billion, included provisions for a future pension reform. The document published by the IMF states that Ukraine should take measures to minimize the pressure from pension-related expenses in the future.

Join our Telegram channel to stay updated on important news. You can subscribe to our Viber channel here.