This was reported on Facebook by the Chairman of the Board of the National Bank of Ukraine (NBU), Andriy Pyshny, who noted that together with the analysis presented in the December Financial Stability Report, this data allows for an assessment of the banks' performance in the lending sector.

“First and foremost, it is important to highlight that we are operating with the net portfolio indicators without considering the reserves formed by the banks. This approach helps to avoid distortions in dynamics (caused by the historically high level of NPL and old loans on the balance sheets of certain banks) and to interpret the data correctly,” explains the head of the NBU.

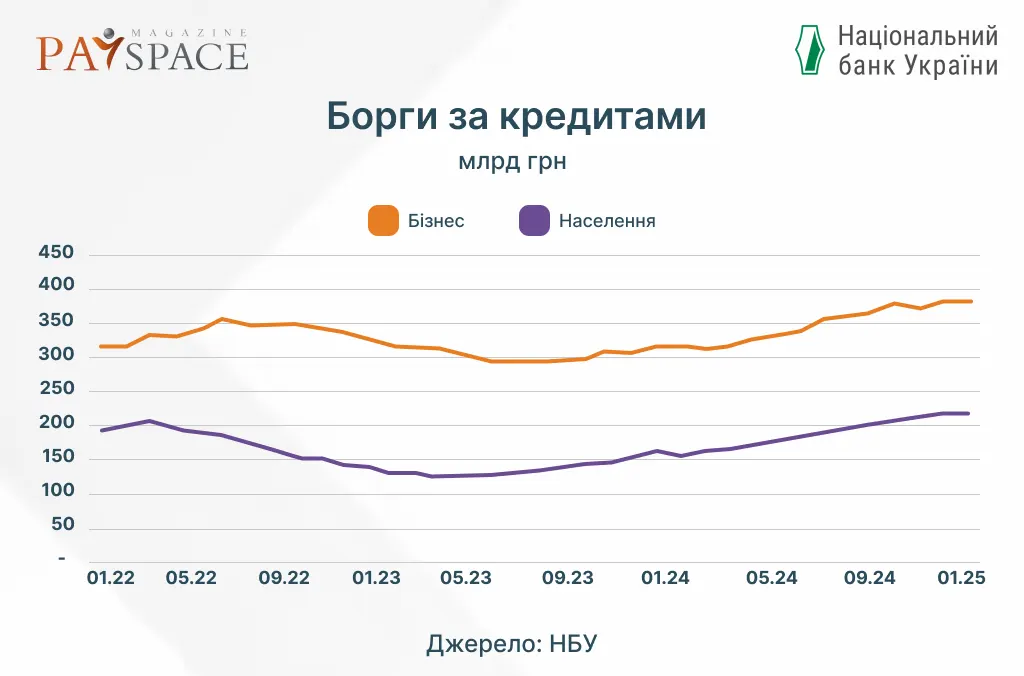

According to him, lending has been steadily growing for over a year in both the corporate and retail segments of the market. The net (excluding formed reserves) credit portfolio for businesses in 2024, based on operational data, increased by 65 billion UAH, or by 21%, while for individuals, it rose by 62 billion UAH, or by 39%.

This is a result of both the recovery in demand for loans from businesses and individuals, as well as an increase in banks' risk appetite.