How will the NBU's interest rate hike affect deposits and government bonds? An analyst's forecast.

The National Bank's increase of the key interest rate to 14.5% is not the end of the road. In its latest Inflation Report, the NBU states that inflation will rise at an accelerated pace, at least until spring of this year. This will compel the regulator to continue "tightening the monetary screws" in the near future, as the NBU's key rate essentially represents the cost of money in Ukraine. Therefore, this time the NBU not only raised the key rate but also changed some rules for banks and their clients in the resource and, indirectly, the currency market. This is mentioned in the column by financial analyst Alexey Kozyrev for "Minfin".

In 2024, Western partners, albeit with delays, have allocated nearly all the financial assistance that Ukraine requested. However, the situation remains tense in 2025. This is true both for the National Bank and the Ministry of Finance of Ukraine, as well as for businesses and the public. The uncertainty regarding the timing and scale of military actions prevents officials from forecasting defense spending. This poses a risk of a new revision of military expenditures and the need to find additional sources to cover emerging budget cash gaps. Meanwhile, Ukraine cannot resort to "printing money," as this requires the consent of the International Monetary Fund, which is currently firmly opposed to such developments.

Despite active international assistance and taxation, the government will need to more actively attract funds from the public to cover budget expenses. Private depositors have over 1 trillion in their bank accounts. To attract these funds into government bonds, the state still maintains a preferential treatment for investors by exempting income from OVGZ from taxation. The net yield on these bonds currently exceeds deposit yields for individuals by 1-3% annually (depending on terms).

It should be noted that the yield on OVGZ mentioned below is offered by the primary market. Citizens are entitled to purchase bonds only on the secondary market through financial intermediaries (banks and financial companies), which reduces their final yield by 0.5-1.5% annually, depending on the terms of the OVGZ. After all, banks account for their commissions, which they either charge separately or simply "embed" in the final yield for the client when purchasing the securities. However, even taking this nuance into account, OVGZ provides higher returns than deposits.

As of January 22, the "net" rates on hryvnia deposits (after taxation) in the banking system average:

- for 3 months - 9.93% per annum,

- for 6 months - 9.856% per annum,

- for 9 months - 9.41% per annum,

- for 1 year - 9.64% per annum.

The highest working rate for hryvnia deposits for 3-6 months from actively operating banks with individuals is currently 15-16% per annum. The net yield on such deposits for citizens will range from 11.55% to 12.32% per annum. This is still lower than the "working" rates for hryvnia OVGZ on the secondary market, which are within "net" 14-15.5% per annum. So far, the Ministry of Finance has a buffer in the form of promised volumes of Western financial assistance, which somewhat "relaxes" officials regarding the activation of work with the public on purchasing OVGZ.

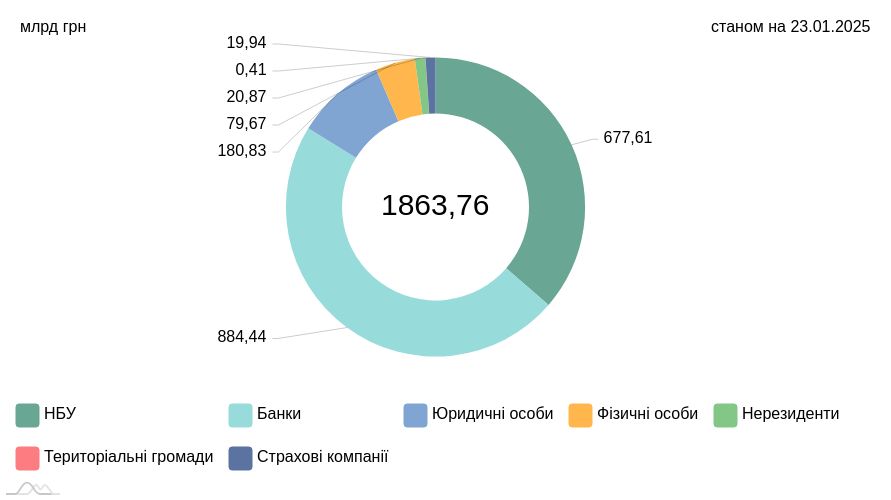

The statistics on the portfolio of OVGZ in circulation remain relatively positive for the Ministry of Finance in terms of its structure. However, there is always a shortage of funds, especially in wartime, so the plan for OVGZ issuance in 2025 is quite tight. Although there will be few "net" new borrowings.

"The government budget project for 2025 included 579 billion UAH in borrowings through OVGZ, while repayments on this instrument amount to 562 billion UAH, meaning the Ministry of Finance planned to receive only 17 billion UAH "net." The rest is the "conversion" of old debts into new securities upon repayment upon maturity," Kozyrev reminded.

If the portfolio of bonds held by the National Bank, banks, businesses, and the public is converted into new bonds, then theoretically it will not be difficult to attract an additional 17 billion UAH from the market for the Ministry of Finance. However, if military expenses continue to rise (which is a realistic scenario) or there are issues with transferring funds, the Ministry of Finance will have to intensify the issuance of bonds. And here, the public as a buyer will be indispensable.

"Therefore, I do not rule out that with the increasing need for funds to finance military expenses, the Government may be forced to raise the yield on hryvnia bonds to increase interest from citizens. According to my forecasts, considering inflationary issues, the Ministry of Finance in such a situation will have to raise the yield on new securities by an additional 0.25-1.5% annually, depending on the terms of OVGZ issuance, with a corresponding revision of the budget expenditure plan for their servicing in 2025.

In this context, banks, considering the NBU's increase of the key rate to 14.5% per annum and the rise in inflationary processes, will also have to gradually raise their deposit rates for citizens by at least 0.5-1% per annum depending on the term of such deposits. However, they will need to act much more swiftly than the Ministry of Finance with OVGZ. After all, deposit maturities in banks occur almost daily, and people will not wait for potential increases in deposit rates if competitors start offering higher rates. Yes, competition among banks will intensify the struggle for depositors, especially among small and medium-sized banks.

So far, the National Bank, as a result of its decision to increase the rate on NBU certificates of deposit "overnight" to 14.5% per annum and on three-month certificates to 17% per annum, is creating opportunities for a fairly prompt increase in deposit yields. However, the overall level of increase in hryvnia deposit rates will depend on the individual schedules of each bank regarding its funding base and business model. The yield on hryvnia deposits, depending on the interest policy of a particular bank, will be:

- for 3 months – from 12% to 16% per annum;

- for 6 months - from 12.5% to 16.25% per annum;

- for 9 months - from 13% to 16.5% per annum;

- for 1 year and more – from 14.5% to 16.75% per annum.

To attract depositors, banks (especially small ones) will begin to actively conduct promotions with additional bonuses. The government faces the task of stimulating banks and the public to redirect their available free resources from NBU certificates of deposit and personal savings towards purchasing OVGZ. This would simplify the task of financing the "gaps" in the budget without the risk of "printing money," reduce the excess liquidity, and lessen pressure on the hryvnia in the currency market. Additionally, this approach would help reduce Ukraine's complete dependence on external financing.

"As for a significant increase in the yields on hryvnia OVGZ by the Ministry of Finance for currently issued bonds (especially for benchmark OVGZ, which are already in high demand from banks), I would not count on it. Given the absence of taxation, large purchases of benchmark OVGZ by banks, and currently significant volumes of international assistance received, officials from the Ministry of Finance are unlikely to be very generous in increasing yields on hryvnia securities for investors. According to my forecasts, the Ministry of Finance will gradually resort to increasing yields on newly issued hryvnia bonds by only 0.25% to 1.5% per annum," Kozyrev added.

The Ministry of Finance will note the increase in yields for 2-3 year bonds, as it needs "long" resources. However, there are not many such funds available among the public. This is why the most popular deposit terms among the public are deposits from 3 to 6 months. In this situation, the majority of bond purchases by Ukrainians on the secondary market will be within 3-6 months until maturity, and at most 1-1.5 years.

Increase of the key interest rate to 14.5%

On January 23, the board of the National Bank made the decision to raise the key interest rate to 14.5% per annum. This decision aims to maintain the stability of the currency market, keep inflation expectations under control, reverse the inflation trend, and gradually slow down inflation to the target of 5%. Containing price pressure will likely require further tightening of monetary policy.

<